PharmExecBlog summed up Cegedim’s “2012 US Pharma Insights” survey this way: “while more pharma companies are using social media and mobile platforms to enhance their sales and marketing initiatives, budgets did not reflect an increase in social media spend” (see Companies Trim Social Media Spending, While Platform Priorities Shift). Andrew Spong “rescooped” this under the headline “Pharma employee use of social platforms up by 36 percent in 2012.”

Once again, we are fed data about pharmaceutical companies that (1) have very little basis in reality, and (2) are not specific to traditional pharmaceutical companies that manufacture and market prescription small molecule and biologics.

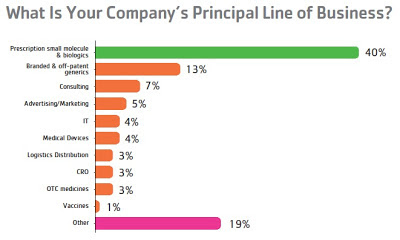

The title of Cegidim’s survey and white paper summary (“2012 US Pharma Insights”) is itself misleading because the majority of respondents are NOT employed by traditional pharmaceutical companies. Only 40% of respondents of Cegedim’s survey describe their

company’s principal line of business as prescription small molecule and biologics. The next biggest “line of business” is “other”:

All the results of this survey that are summarized in a Cegidim white paper reflect the total responses, including the 60% of respondents who are NOT employed by traditional pharma companies; i.e., generic companies (which do very little marketing), consultants, ad agencies, and “other.”

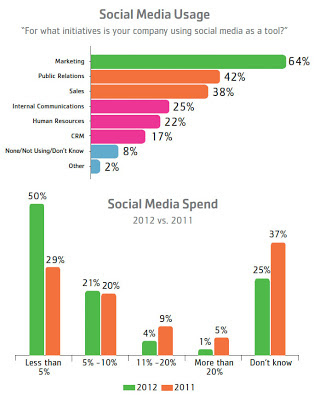

Regarding social media use and spending, the white paper includes these two charts:

How can you interpret these results to say anything that reflects the actual situation with regard to traditional pharma companies? Perhaps 90% of the 50% who said that social media spending by their companies was less than 5% are employed by traditional pharma companies. Perhaps 90% of the 42% who said their companies use social media for Public Relations and only 20% of the 64% who said their companies use social media for marketing are employed by traditional pharma companies. Or maybe it’s vice versa. Who knows?

Unless we can see the data specifically from the 40% of respondents who are employed by traditional pharma companies, we cannot make any conclusions about how to apply these data to traditional pharma companies.

As for (1), although I am not an expert in statistics, I suspect that the N in this survey was much less than 1,000 because Cegidim claims that “percentages are subject to a 6.709 point margin of error and were tested for significance at the 90% confidence level.” To me, that sounds like N=200, more or less.

I’ll contact Cegidim to see if I can get only the results of this survey from the 40% of pharma respondents and report back here. I only wish that PharmExec, Andrew Spong, and the dozens of other people reporting these results as “pharma” data would have done that for me.

UPDATE: I received a response from a Cegidim spokesperson in my voicemail box: “I do not have an analysis of the segment you are looking at, just an analysis of the entire universe.”

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)