@QuintilesIMS teamed up with #PharmaForce to provide a framework for product launch assessment. The following is an excerpt. Download the entire report here.

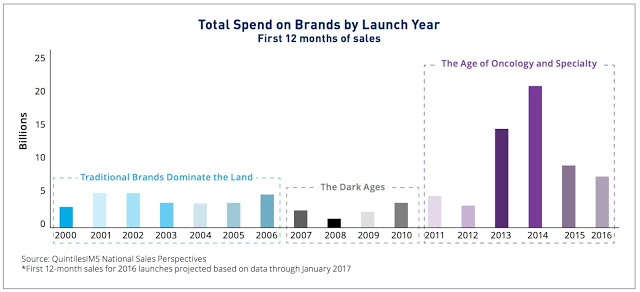

The chart below shows the total amount of revenue associated with launch brands in the year that they launch. “From 2000-2006,” notes QuintilesIMS, “we see that somewhere between $3 billion and $5 billion were spent on launch brands in the first 12 months in which they were launched. These are your traditional, big primary care type of products.”

Further quoting from the report:

“The launch figures dropped down in 2007-2010, and this is where you see launch brands generating somewhere around $2 billion and $3 billion. We call this the Dark

Ages. Anyone in pharma during these years can recall thinking that the age of pharma is not what it used to be, if there would be any major launches, or if innovation was dried up.

“Then what we see are some of the biggest launches in the history of the pharmaceutical industry. The total spend on launches in a particular year in 2013 and 2014 is up to $15 billion and $20 billion. Payers are spending a lot more on launch brands. We can still see even in 2015 and 2016 that payers started to put more restriction in the process, but it’s still in that $8-billion-to-$10-billion range.

“The brands that are excelling during this timeframe are the oncology and specialty drugs. Specialty drugs would include hepatitis C, there are a lot of strong oncology drugs, and we also see some central nervous system drugs around multiple sclerosis and other types of diseases. We certainly see many specialty drugs coming into play here which are really driving that. The question becomes: As we start to see some of the trends drop down in

2015 and 2016, will the specialty drugs be able to maintain the influence they’ve had going forward?”

Download the entire report here and find out how to prepare for tomorrow’s challenging launch landscape.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)