Rahm Emanuel, president Obama’s Chief of Staff, warned advertising industry leaders some time ago that the business-tax deduction for DTC (direct-to-consumer) spending could be taken away in 2009 tax legislation (see “Obama, Democrat Win Could Cause Ad Industry ‘Pain’“).

Rahm Emanuel, president Obama’s Chief of Staff, warned advertising industry leaders some time ago that the business-tax deduction for DTC (direct-to-consumer) spending could be taken away in 2009 tax legislation (see “Obama, Democrat Win Could Cause Ad Industry ‘Pain’“).

Yesterday, Bloomberg.com quoted House Ways and Means Committee Chairman Charles Rangel as saying “one thing that’s not off the table is you can pick up $37 billion knocking out the deduction for advertising” for prescription drugs (see “House Considering $37 Billion Drug Tax, Rangel Says“). He was suggesting this as one way to help pay for the pay for a health-care overhaul.

Where did Rangel come up with that $36 billion number? The US drug industry spends about $4.7 billion per year on DTC advertising. How can eliminating the business tax deduction on that expense yield an amount 7-8 TIMES that? I’m no accountant, so I need some help here.

UPDATE: A partial explanation was presented in a followup AdAge article:

“Mr. O’Brien [exec VP-director of government regulations for the American Association of Advertising Agencies] said the $37 billion would be spread out over the 10 years of funding the health-care reform bill, but still questioned the number. ‘It comes out to $3.7 billion in taxes a year on advertising spending of about $5 billion a year — that’s steep even by Swedish standards.'” [See “Industry Mobilizes to Fight Off Congress’ $37 Billion Ad Tax“.]

The proposal is not to levy a NEW tax, but eliminate a tax break, a distinction that may be minor to many. Paying $3.7 bn on $5 bn of added income does seem very high and one wonders how even that number was calculated. I am sure the drug industry is NOT in the 75% tax bracket! Maybe 25% might be a better estimate. Therefore, by eliminating the tax break on $5 bn, the government is likely to gain only $1.25 bn per year or $12.5 bn over 10 years.

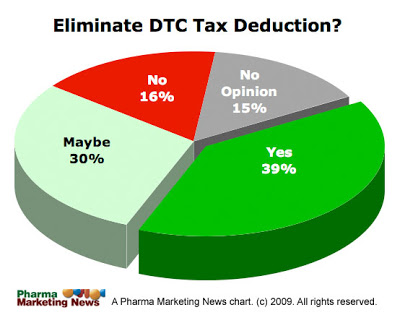

Meanwhile, 69% of respondents to the Pharma Marketing News Future of DTC Survey said “yes” (39%) or “maybe, it depends” (30%) when asked if the DTC business tax deduction should be eliminated (see chart). You can take this survey here and give you opinion about this and other issues that will have an imp[act on the future of DTC. Afterward, you can view a summary of the latest, de-identified results.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)