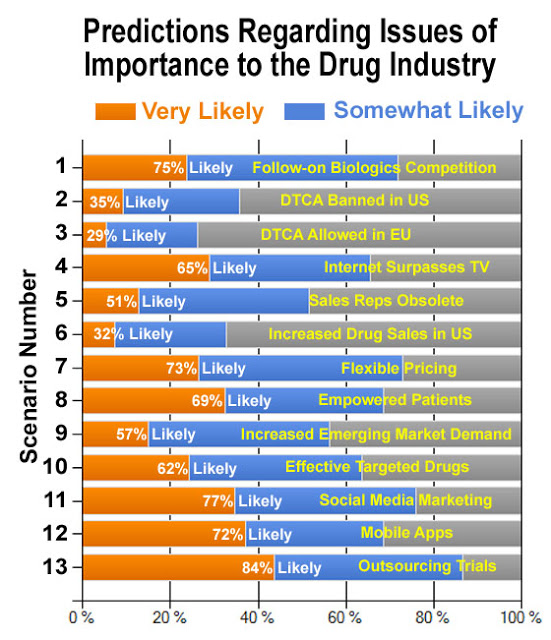

It’s time to revisit a survey I ran a couple of years ago that attempted to predict future healthcare market scenarios that would impact the drug industry. The survey asks respondents how likely it is for certain events or conditions to unfold in the next 4 years or so.

You can take the survey here. But before you do that, let’s review the first-round of results (ie, responses collected from 2 December 2009 through 8 January 2010). Events since then may have made some of the following scenarios more or less likely. You tell me.

The scenarios — with my updated comments included in brackets [] — that are included in the survey are as follows (see the chart afterward for the first-round results):

- New follow-on biologics legislation in the U.S. will increase competition from generic equivalents and eventually decrease brand profits. [I think the legislation is still bogged down and when finalized may not have much impact within the time frame specified.]

- Broadcast (ie, TV) Direct-to-Consumer (DTC) drug promotion will be banned or sharply curtailed by law in the U.S. [This may have been a big issue back in the day, but it doesn’t seem to be center stage right now.]

- The European Union will finally allow Direct-to-Consumer (DTC) advertising to its citizens. [The European Commission, the executive arm of the EU, recently ruled that pharma companies would not be allowed to disseminate information about drugs and their indications beyond a narrow set of circumstances. For the details, see, “In Rejecting Proposal, EU Dashes Drugmakers’ Hopes of Having a Voice“]

- Internet-based drug promotion (including search engine marketing) will overtake TV-based DTC in the U.S. in terms of dollars spent. [There’s still time for this to happen. I’m guessing that right now only about 5% (maybe 10% if you include search advertising) of pharma’s DTC advertising budget is spent on Internet advertising whereas TV accounts for over 50% of the budget. See “Double Dip in DTC Spending Plus 33% Drop in Internet Display Ad Spending!“]

- Due to decreasing effectiveness of traditional physician detailing and rise of non-personal detailing, the role of traditional sales representative will become obsolete. [I’m surprised that over 50% of respondents think this is likely to happen before 2020 (see chart below). Perhaps a sign is the recent closing of Pharmaceutical Representative Magazine (see here). Also read this article: “Consequences of eDetailing Technology“.]

- New healthcare reform legislation will dramatically increase the sales of drugs in the U.S.

- Extensive outcomes data available to payers and comparative effectiveness research will force the industry much further down the path of pay-for-performance (ie, adopt a more flexible approach to pricing). [For background in this, read the article “A Case for Supporting Comparative Effectiveness Research“.]

- Patients will become even more influential and empowered in making healthcare decisions as they are forced to pay a larger share of costs and/or have access to health information from a variety of sources. [For more background on this, read the article “The Empowered Patient: What It Means for Pharma Marketers“.]

- Despite lack of innovative new drugs and/or generic competition, sales of brand drugs worldwide will show a sharp increase due to increased demand in emerging markets (eg, China). [See the following articles: “Getting Market Research Right in Emerging Markets“, “Getting Market Research Right in the Middle East“, and “Getting Market Research Right in India & China“.]

- More efficient targeting of drugs and marketing to specific patient populations will greatly increase effectiveness and decrease side effects of drugs. [See, for example, “New Big Pharma Economies of Scale: Less Patients Needed to Reach Blockbuster Sales“. At least one targeted therapy (I can’t recall which), however, recently failed and that may cast a shadow on progress in this area.]

- Social media marketing will become a significant part (>10%) of the pharmaceutical marketing mix. [Hmmm… A lot of people seem to believe this is likely (see chart), but FDA’s delay in issuing guidance may have dampened the outlook for pharma use of social media.]

- The next BIG opportunity for targeted marketing to patients and physicians is mobile apps on “smart phones.” [To prepare for this, I recommend you read the article “Everything You Need to Know About Mobile Platforms“. Take the survey and you will get a discount code that allows you to get this at no charge.]

- Pharmaceutical and biotech companies will continue to increase their outsourcing of clinical trials and related drug development. Outsourcing will account for more than 50% of R&D spending by 2019.

The following chart summarizes first-round (prior to January 2010) survey results. Please take the survey now and help me get a more current view of what may be dow the road.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)