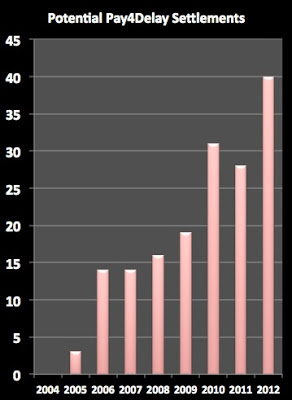

According a new Federal Trade Commission (FTC) staff report, in Fiscal Year (FY) 2012, the number of “potentially anticompetitive patent dispute settlements” (aka, “Pay for Delay” deals) between branded and generic drug companies increased significantly compared with FY 2011, jumping from 28 to 40 (find the report here).

Here’s a plot of the data showing the trend over the past 9 years:

The study also found that in nearly half of these settlements, branded firms may have used the promise that they would not develop or market an authorized generic (AG) as a payment to stall generic drug firms from marketing a competing product.

Why the big jump in these deals? It’s another indicator that pharma has fallen off the patent expiration cliff and is using these deals to ensure “soft” landings. I thought, however, that such deals would have declined in the face of recent FTC challenges such as the complaint against Solvay Pharmaceuticals. According to the FTC, Solvay paid generic drug makers to delay generic competition to its branded testosterone-replacement drug AndroGel (see “FTC Sues Drug Companies for Unlawfully Conspiring to Delay the Sale of Generic AndroGel Until 2015″). Now that there’s Androgel 1.62%, a whole “new” formulation approved for marketing by the FDA, any previous pay-for-delay deal is beside the point.

Aside from developing new formulations, drug companies have other ways to avoid costly and public image busting pay-for-dealy deals. You might recall, for example, that Pfizer tried to extend the marketing life of Lipitor by implementing an innovative “Save the Lipitor Cash Cow” battle plan, which included:

- keeping marketing at a high level instead of the typical two-thirds dropoff during the final year of patent protection,

- offering insured patients a discount card to get Lipitor for $4 a month,

- paying pharmacies to mail Lipitor patients offers for the $4 copay card and to counsel patients about the benefits of Lipitor,

- negotiating unusual deals with some insurance plans and prescription benefit managers

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)