Often, when proponents of pharma eMarketing get together at industry conferences, or cry into their beers at receptions afterward, they lament the fact that the drug industry isn’t doing as much as other industries in the “e” arena. Sometimes, they cite eMarketing campaigns of companies like Procter & Gamble (P&G) and ask, Why aren’t drug companies doing that?

The responses to that question generally fall into the category of “It’s Regulations, Stupid!” That is, FDA regulations are hampering what pharma marketers can do online. The packaged goods industry — of which P&G is a member — is not regulated like the drug industry is regulated. True that!

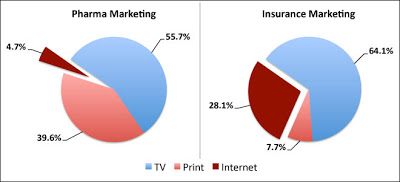

So, let’s look at another industry that IS regulated: the insurance industry. Where do insurance marketers spend their dollars and how does that compare with pharma? It just so happens that I came across some data that might shed some light on that (see the chart below; click on the chart to enlarge).

The data come from Kantar Media. The Internet data does NOT include search advertising. The insurance data is for the first three quarters of 2011 (total spend = $3.56 Bn) whereas the data for pharma is for 2010 (total spend = $4.3 Bn). To compare apples to apples, in 2010 the insurance industry media spend pie looks like this: TV, 54%; Print, 6%; Internet, 21%.

No matter how you look at it, the insurance industry favors Internet over print whereas the opposite is true for pharma. Why?

Here’s what I have learned from personal experience. In my family — and probably in your family too — health decisions and purchases are generally the domain of my wife, whereas insurance decisions and purchases are my responsibility. It’s no secret that pharma marketers target mostly women. My wife reads magazines like Prevention, etc. that feature a lot of drug ads. I don’t read these magazines. While I have seen print ads for insurance companies, they haven’t made much of an impression on me, whereas TV ads have.

So, from my personal experience, it’s logical that both industries allocate a big portion of their media spend on TV advertising, but only the drug industry spends a lot on print advertising.

What’s surprising, however, is the insurance industry’s 28% of total media spend on the Internet (versus 5% for the pharma industry).

Coincidentally, yesterday I received an e-mail message from Geico about their “Family Pricing Program” for my son Greg. (We are Geico customers, having both our car and home insurance with them.) The message said:

“If Gregory is getting ready to graduate, preparing for a new job, or looking to establish a little independence, our Family Pricing program allows you the freedom of moving Gregory to his own policy while he continues to receive the same great rates you’re currently receiving.”

That spooked me a bit because Greg just started his first full-time job after graduating and I mentioned to my wife that soon it will be time for Greg to get his own insurance policy! I tweeted:

“Got email from Geico about transferring my son 2 his own car insur plan now that he has a job. How’d they know I was just thinking that?”

Of course, they didn’t know what I was thinking, but it was nice to know that they anticipated what I may be thinking! Geico knows a lot about me and my family. They know our ages, our sex, our driver’s license numbers, our driving records, what kinds of cars we own, etc. I had to give them that information to get insurance. No big deal.

So, it would be easy for Geico to anticipate that Greg recently graduated and that he may have a new job. Further, they know from experience that parents want to get their kids off their insurance plans ASAP.

After I posted that tweet, I received this response from “Shay” tweeting from the @GEICO_Service Twitter account:

“We would be more than happy to give him a quote! He can go to geico.com or give us a call at 1-800-861-8380. -Shay”

That was a pleasant note that makes this whole experience even more personal than if I just got an e-mail message.

When I complained that Greg was likely to push back on the idea of paying his own insurance, Shay reassured me that “We will do everything we can!” and added: “Thank you so much for being part of the GEICO family!”

I don’t think I can leverage this new found “family” relationship to get an even better deal from Geico, but the experience made me an even better fan of Geico — I was already impressed with their online services. Hopefully, if we ever need to make a claim, I will be equally impressed.

Can the pharmaceutical industry do something similar? I’m not sure. The first hurdle for pharma is breaking away from print. As I said, pharma marketers may depend upon print to reach their core audience — women. But they may be ignoring social media’s ability to reach that core — listen, for example, to this podcast: “How to Score With Women (as a Marketer) via Social Media.”

Keep in mind, however, that social media marketing is virtually “free” compared to print advertising, which is something the packaged goods industry is learning (see “The Coming Pharma Digital Depression“). Given that, even if pharma moves big time into social media marketing, I’m not sure the spend pie would look much different. The insurance industry probably spends a lot more on internet display advertising and e-mail direct marketing than does the pharma industry. These activities are much more expensive than paying Shay to reach out to me via Twitter!

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)