An article entitled “The Marketing Maze” in a special marketing section of yesterday’s Wall Street Journal presents a breakdown of US advertising expenditures for 2005. The source for this data is TNS Media Intelligence. The article raises a couple of interesting points that I would like to focus on and relate to pharmaceutical marketing & advertising.

[The WSJ, like many other media, equate marketing with advertising. However, my view is that marketing — and pharmaceutical marketing in particular — also includes public relations, buzz, and word-of-mouth promotion, which are traditionally not considered advertising. For more on this, see “PR Marketing: Mystery Wrapped in a Riddle” and “Marketing Disguised as PR.”]

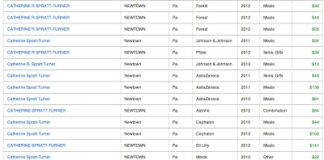

The TNS data adds up to nearly $100 billion spent in 2005 on advertising to consumers in the US ($99.4 billion to be precise). However, this data excludes Internet search from the $8.3 billion Internet advertising total. Another WSJ article on the same page (“Wisdom for the Web“) provides that bit of data: “Search advertising exceeded $5.1 billion in the U.S. last year and represented the largest category of Internet ads, according to the Interactive Advertising Bureau (IAB) trade group and consulting firm PricewaterhouseCoopers.”

The IAB reports that “Internet advertising revenues for 2005 are estimated to exceed $12.9 billion, a 30% increase over the previous revenue record of $9.6 billion in 2004” (see Press Release). This is about 13% of the total ad revenue (see charts below). This includes data concerning online advertising revenues from Web sites, commercial online services, free e-mail providers, and all other companies selling online advertising. I assume search advertising is included. The IAB also reports that Internet advertising revenues reached a new record of $3.9 billion for the first quarter of 2006 (see press release).

Internet search advertising is expected to grow to $10 billion by 2009. This may bring it up to par with Internet display advertising. Yet, from my own experience based on one pharma brand team’s comments, search is viewed as a limited option for pharmaceutical marketers and not destined to make a dent in their marketing budgets. This one brand team’s view of search is that you can only spend so much on search engine optimization and purchasing key words on search engines. The total is a miniscule amount of the overall pharma ad spend. I don’t argue with that. However, this kind of thinking allows marketers to pay too little attention to search marketing, which actually requires a lot of attention if it is to be effective.

Unfortunately, search engine marketing is grunt work and not a high-profile endeavor. Hence, most pharma ad agencies of record downplay it’s importance.

Back to the data. I combined all the TNS data with the IAB data and came up with the following pie chart showing the overall media mix for consumer advertising (the “Internet, Search” category is the combined search and display data):

Pharma spends about $4.5 billion on direct-to-consumer advertising or less than 5% of the advertising total.

NOTE: I did not include marketing/advertising by pharma to doctors because I want to compare pharma spending to that of other industries, which do not advertise to specifically to doctors outside their role as consumers.

I am too lazy to try and find out what other big industry categories such as the automotive and beverage industries spend on advertising (anyone know?). But I suspect it is much larger than 5% of the total pie.

OK, here’s a quick and rough calculation for the auto industry: eMarketer reports that the auto industry allocates about 2.5% of their advertising budget to online and that in 2005 the industry spent about $1.4 billion online (see “Automotive Marketers Rev Up Online Advertising“). A little math using these numbers suggests that the auto industry spent about $56 billion on advertising is 2005. That is 56% of the total spent by all advertisers!

NOTE: Other data suggest that the auto industry spent $31 billion on ads last year, or 31% of the total. Still, the auto industry spends a lot more on consumer advertising than does the pharmaceutical industry.

BTW: The auto industry allocates less of their ad budget to online advertising than does the pharmaceutical industry. It probably also spends a lot more on TV than does pharma. This only illustrates why the auto industry is not doing too well and why the pharma industry should not follow its advertising model.

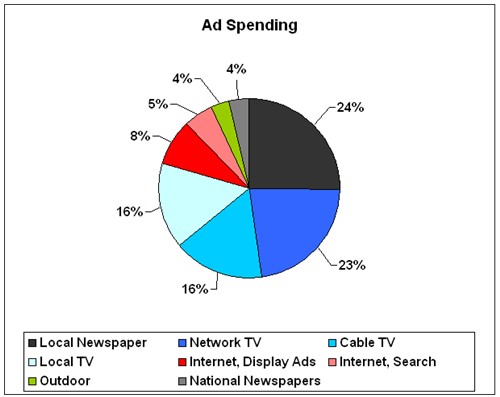

The following simplified charts are designed to make it easier to compare pharmaceutical ad spending to overall ad spending. The overall spending mix (shown on left) is based on the above data, the pharma chart is based my best estimate.

Pharmaceutical marketers allocate a disproportionately larger share of their advertising budgets to broadcast (TV and radio) — 70% versus the overall average of 54%. This is why it seems that pharmaceutical companies spend more on consumer advertising than other industries. The TV drug ads are relentless (but not as relentless as auto ads)!

On the other hand, it is a well-known fact that pharmaceutical marketers allocate a much smaller part of their ad budgets to the Internet channel than do most other industries (auto industry excluded). Why is this? Let me know you opinion.

If you are interested in learning more about online pharmaceutical marketing, you might want to get hold of the ePharma Supplement to Pharma Marketing News.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)