There’s no denying two facts:

FACT #1: Spending on prescription drugs is increasing dramatically. The Chicago Tribune, quoting data from IMS health, reported (here) that “Spending [in 2014] rose 13 percent [vs. 2013], the biggest jump since 2001, to a total of $374 billion” and

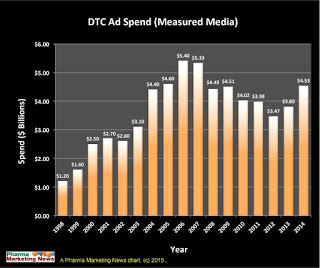

FACT #2: Spending on Direct-to-Consumer Advertising (DTCA) of prescription drugs is also increasing – more so, in fact. Kanter Media reported that the drug industry increased measured media ad spending by 19% in 2014 vs 2013 to $4.5 Bn (see chart below).

|

| Click on chart for an enlarged view. |

Is there a causal link between these two facts? Does DTC advertising raise the cost of drugs?

The American Medical Association (AMA) seems to think so. A few days ago, it called for a ban on Direct-to-Consumer Advertising (DTCA) of prescription drugs (see here).

According to the AMA press release, the voting physician delegates were “responding to the billions of advertising dollars being spent to promote prescription products” and the new policy was “aimed at driving solutions to make prescription drugs more affordable.”

Some DTCA critics suggest that pharma companies artificially raise prices of advertised drugs to cover the cost of advertising. But the AMA press release also suggested that DTCA “inflates demand for new and more expensive drugs,” which is not the same thing.

Much research has been done to determine if brand drug prices are artificially set by drug companies in anticipation of competition and to cover the costs of Direct-to-Consumer Advertising (DCTA). You can read my summary of that research in this Pharma Marketing News article: “Consequences of Direct-to- Consumer Advertising.“

Other research and data analysis rebuff the causal link between DTC and drug prices. Read, for example, “Villanova Scientists Long Ago Proved that DTC Spending Does Not Impact Rx Prices.” Also, a report from the Congressional Budget Office, concluded that pharmaceutical manufacturers tend to spend more, on average, on DTC advertising for drugs that have few or no direct competitors (see here).

In any case, spending on DTCA represents only 1% of drug sales! And if the ROI of DTCA is 2:1, then $4.5 bn in advertising to consumers generates only $9 Bn in sales that would not have been made otherwise — that’s only 2% of total sales. It’s unlikely that a 13% increase in drug prices was driven by an increase in expenses of 1%.

Meanwhile, is the Association of National Advertisers (ANA), which benefits from DTC advertising, said the AMA’s approach — i.e., DTC ban — is “wrong and misguided” and “would roll the clock back decades to the days when only doctors could be ‘trusted’ to receive information about important health issues” (see here).

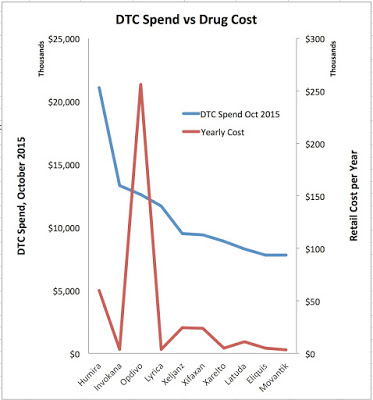

P.S. To see if there is a direct relation between the amount of money spent on advertising specific drugs and the cost of those drugs, I looked at the top 10 advertised drugs in October 2015 (here) and compared the ad spend to the yearly retail cost of the drugs. I came up with the following chart, which appears to show that some relatively low-cost drugs (e.g., Invokana and Lyrica) are among the most heavily advertised pharma brands:

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)