“Not all available market research is created equal,” says Rich Meyer, author of DTC Marketing Blog. According to Meyer, “some research is a must have and provides insights, but there is also a lot of available research that doesn’t clarify findings and is written by journalists not people will real world pharma business experience.” He goes on to rate various sources of pharma marketing research (here).

Meyer has two ratings:”A-Must Have” and “D-Pass,” which means don’t bother with it. Meyer doesn’t have a “C-Meh!” rating — that’s my way of saying “lackluster, take it or leave it.”

One study “written by journalists” is the MM&M/Ogilvy CommonHealth Healthcare Marketers Trend Report, the 2014 version of which was just published (here). Let me tell you why I give it a “C-Meh!” rating.

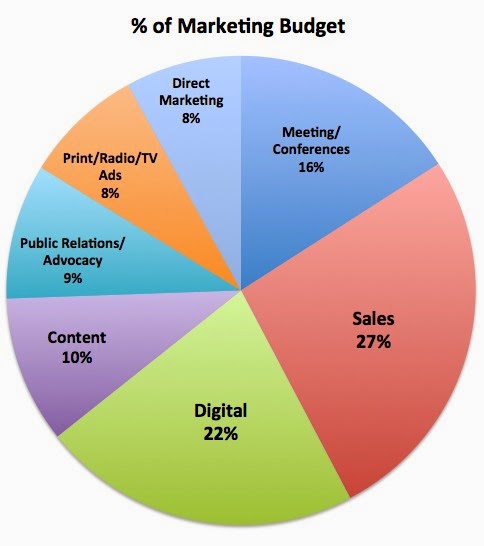

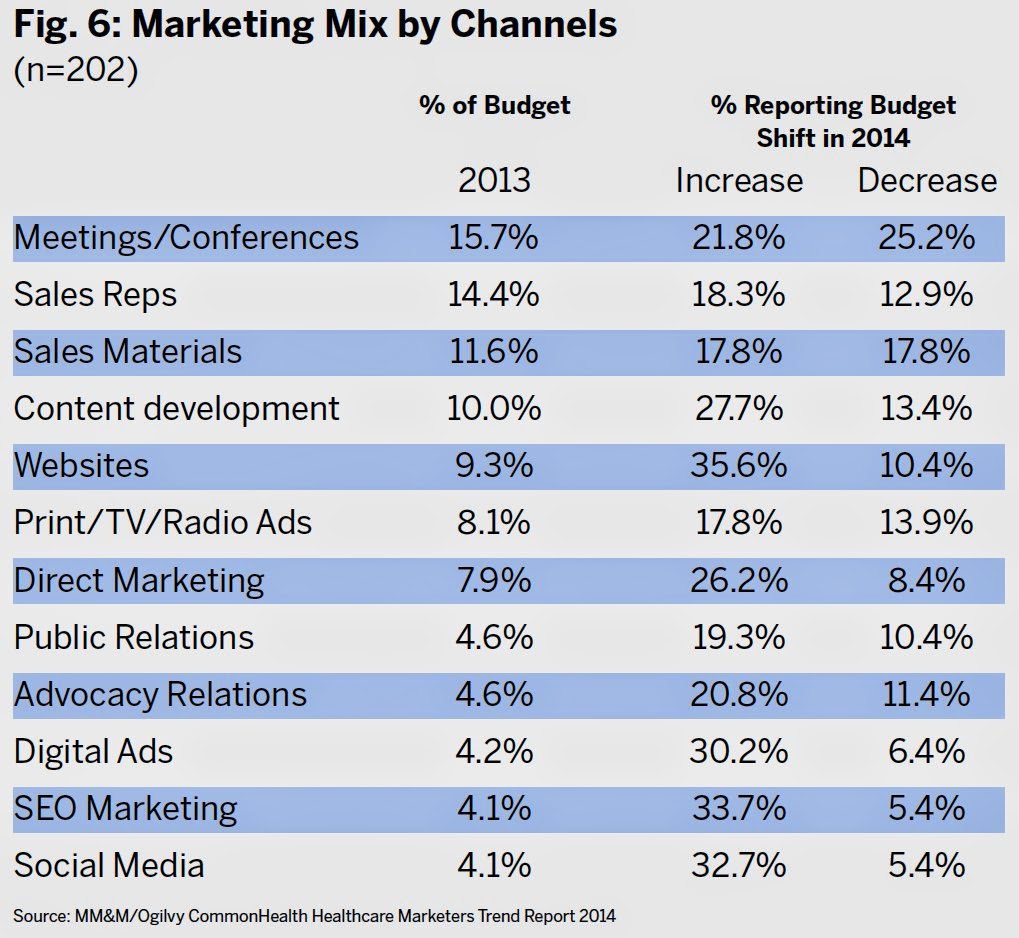

One surprising finding of this survey of 202 “qualified” senior executives — “all director level and above” — employed by pharmaceutical, biotechnology, devices and diagnostics companies, is that 22% of pharma marketing budgets of these individuals goes to some form of digital marketing (websites, digital ads, SEO marketing, and social media).

Here’s the tabulated data:

I combined some categories to get a less granulated view for plotting in a pie chart that would allow better comparison to other sources of similar data:

|

| Digital = Websites+Digital Ads+SEO+Social, Sales=Sales Reps+Sales Materials |

I have no idea what “content” means in context of this survey; so I just left it a category of its own.

Aside from the surprising 22% allocated to “digital,” these executives claim that only 8% of their budgets go to print, radio, and TV ads and only 27% is devoted to sales.

These numbers are surprising when you compare them to other sources of information about pharma marketing mix. Nielsen, for example estimates that the pharma industry as a whole spent $3.74 billion on TV, print, and radio advertising in 2013. That’s about 22% of the estimated $17 billion overall marketing spend by the industry. For digital, I’ve seen estimates around 2-3% for display ads and websites and maybe the same for SEO marketing — to be generous, let’s say 10% devoted to these digital categories overall — that’s half of the 22% reported in this survey. Professional detailing (i.e.., Sales) estimates from other sources say this category accounts for 68% of the overall pharma marketing spend (see “Pharma Promotional Spending in 2013“).

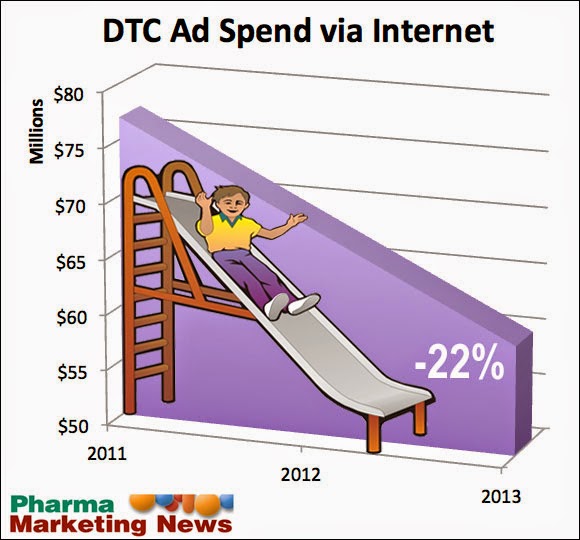

I have spent some time analyzing the marketing mix numbers because MM&M also spends a lot of time discussing this and making a case that digital spending is trending up, up and away (eg. greater than 30% increase year over year, 2012 to 2013).

From my analysis of other sources of information, digital spending by pharma as a whole may, in fact, be decreasing! See for example, this data trend from Nielsen (read “Is Online Pharma DTC Ad Spend Continuing Its Downward Slide?“):

|

| Source: Nielsen measured media audit. |

One caveat: Nielsen data does not include SEO, Websites, and social media.

In any case, from my limited understanding of statistics, you cannot have meaningful quantitative results with less that 1,000 survey respondents. I think the authors of this survey realize this; a disclaimer says: “Results are not weighted and are statistically tested at confidence levels of 90% and 95%,” which begs the question: Did the statistical tests fail?

Only 200 out of 9,241 invited executives responded to the survey, which was done online and offered a $25 gift card to each respondent. Right away that signals to me a self-selected group.

Another problem with this survey is the mix of respondents — only 52% represented pharma, 43% were from “small companies,” and only 37% claimed sole responsibility for marketing budgets. This makes it difficult to get any useful quantitative insights from this study regarding the marketing mix of pharma companies and it explains the discrepancies noted above.

Although I give this survey a “C-Meh!” rating as far as market mix research goes, the survey does include other, perhaps more insightful results regarding the opinions of these executives.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)