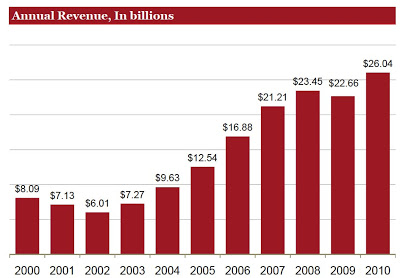

Internet advertising revenue in the United States totaled $26.0 billion for the full year of 2010, whereas ad revenue earned by newspapers was $22.8 billion, according to a PwC/IAB report (see here). Here’s the distribution of ad revenue charted by category:

Here’s the trend in annual Web ad revenue from 2000 through 2010:

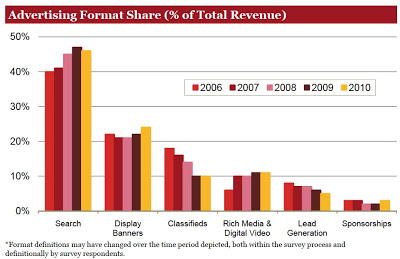

Search continues to get the largest share of online revenue, although this share decreased to 46% in 2010 from 47% in 2009. Still, search revenue totaled $12.0 billion in 2010, up over 12% from $10.7 billion in 2009. Display-related advertising revenues — which includes revenue from display banners, rich media, digital video, and sponsorships — totaled $9.9 billion or 38% percent of 2010 revenues, up 24% from the $8.0 billion reported in 2009. Digital video ad revenue accounts for 5% ($1.4 billion) of the total Web ad revenue.

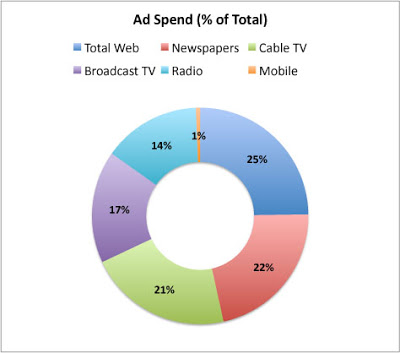

From these data, you might assume that the drug industry spends 25% of its ad dollars on Web advertising. That could be a false assumption. It’s generally believed that the drug industry Web advertising slice of total ad spend is much less than 25%.

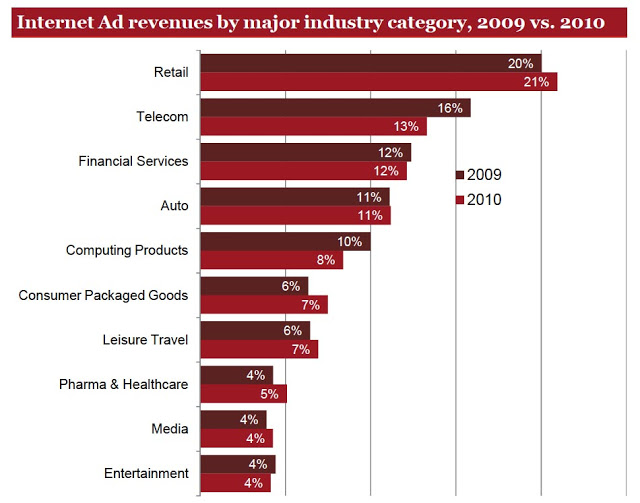

Finally, according to PwC/IAB, here’s the percent of total Internet ad revenues from different industries:

GUESSTIMATING Total Pharma Web Ad Spending

Pharma & Healthcare are near the bottom of this chart. 5% of $26.0 billion is $1.3 billion, which is what the Pharma/Healthcare industry spends on Internet advertising (INCLUDING search) according to PwC/IAB. Let’s say 80% (ie, $1 billion) of that is Pharma-related. Pharma spends about $4.5 billion in direct-to-consumer advertising. It may spend the same in advertising to physicians — not counting samples and sales rep expenses. If my guesstimate is correct, then $1 billion accounts for about 11% of the total pharma ad spend.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)