Vol. 9, Issue No. 9: NOVEMBER 2010 – EXECUTIVE SUMMARYPharma Collaboration with Online Patient Opinion Leaders Upfront Commentary

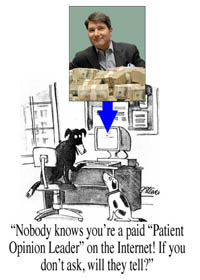

The pharmaceutical industry has a long tradition of working with individual patients and patient organizations. Currently, pharnaceutical marketers are talking about “stepping in” to join discussions patients are having online. In the near future pharma companies may hire influential online patients to act as “patient opinion leaders” (POLs) just as they have hired physicians to be key opinion leaders (KOLs).

The pharmaceutical industry has a long tradition of working with individual patients and patient organizations. Currently, pharnaceutical marketers are talking about “stepping in” to join discussions patients are having online. In the near future pharma companies may hire influential online patients to act as “patient opinion leaders” (POLs) just as they have hired physicians to be key opinion leaders (KOLs).

It’s time to determine the issues involving transparency and conflicts of interest that may arise if and when pharma companies pay individual POLs to help manage their engagement with patients online. What best practices should govern pharma’s collaboration with POLs? Should the industry develop guidelines for their interactions with POLs? This OpEd is a call for action and input from readers regarding these issues and questions.

Read this entire OpEd piece by John Mack here:

http://www.news.pharma-mkting.com/PMNews_99_UpFront.pdf Physician-Generated Content on Social Media Sites Survey of DocCheck Members

With over 710,000 users, DocCheck® is one of the most heavily subscribed medical portals in the world. Recently, Pharma Marketing News and DocCheck collaborated to survey members of the DocCheck online community.

With over 710,000 users, DocCheck® is one of the most heavily subscribed medical portals in the world. Recently, Pharma Marketing News and DocCheck collaborated to survey members of the DocCheck online community.

The goal of the study was to depict the usage of social media (online networks) within the target group of physicians. The influence and importance of social media as a modern channel of communication is growing constantly, also in the pharmaceutical sector. To date, there has been no study that focuses on the usage behavior of physicians on social networks. The present study aims at contributing to knowledge in this field.

Specifically, the following data were assessed: type of networks used, the frequency of posting, motivation for posting, estimation of network usage, relevance of content posted and an evaluation of the importance of online physician-generated content in the future.

Topic headings include:

- Paying Physicians for Content vs. Social Media

- About DocCheck

- Composition of Survey Sample and Demographics of Respondents

- Many Physicians Post Content

- Online Networks Used By German Doctors

- How Often & Why Do Doctors Post Medical Information?

- Doctors Find Online Information Useful

- Future of Social Media and Peer Review

Getting Market Research Right in the Middle East A Land of Diversity, Opportunities and Unique Challenges

This is the second in a series of three articles highlighting points made by Kantar Health executives in a recent webinar entitled “Getting It Right in the Emerging Markets: Identifying the opportunities and avoiding the pitfalls in conducting market research in new geographies.”

This is the second in a series of three articles highlighting points made by Kantar Health executives in a recent webinar entitled “Getting It Right in the Emerging Markets: Identifying the opportunities and avoiding the pitfalls in conducting market research in new geographies.”

If the Middle East was a single country, it would be the fifth largest market in the world in terms of GDP. The sales of pharmaceuticals in the Middle East surpasses $20 billion per year. That’s about equal to the UK Pharma market but unlike the UK, the Middle East is growing by 10 to 15% per year.

The Middle East is not only a land of demographic diversity, but also a land of diversity of health systems and also a land of opportunities. To succeed in this market, pharmaceutical companies must get the best possible market data, which is often difficult to do. In this article, Sherif Shafick, General Manager, Middle East and Africa for Kantar Health, provides some insights on the nature of pharmaceutical market in the Middle East and a case study on how these insights can help launch products.

Topic headings include:

- Importance of Emerging Markets

- The Middle East – A Land Of Diversity

- Individual Markets in the Middle East

- The Middle East – A Land Of Opportunities

- Unique Challenges

- Case Study: Bonding Emotionally with Physicians

Download PDF file Capturing & Reporting HCP-Related Meeting Spending Let the Sunshine In

Life science companies are struggling to understand the complex reporting requirements and compliance issues presented by existing and new regulations such as the Sunshine Act, provisions of which were included in the Patient Protection and Affordable Care Act. These laws are putting the public spotlight on healthcare provider (HCP) meetings and meeting-related expenses.

Life science companies are struggling to understand the complex reporting requirements and compliance issues presented by existing and new regulations such as the Sunshine Act, provisions of which were included in the Patient Protection and Affordable Care Act. These laws are putting the public spotlight on healthcare provider (HCP) meetings and meeting-related expenses.

“There’s been a lot of public scru-tiny on meetings expeditures,” said Kevin Iwamoto, Vice President, Enterprise Strategy, StarCite. Iwamato was speaking at a recent webinar titled Capturing HCP-Related Meeting Spend Doesn’t Have to be Difficult, which was hosted by StarCite — a meetings management technology company. “There’s been scrutiny due to the PhRMA Code, the Sunshine Act, and new EMEA (European Medicines Agency) global codes,” said Iwamato. “All of these require life science companies to do strict tracking and monitoring of royalties, honorariums, speaker’s fees, entertainment and travel costs, etc.”

This article is a summary of the StarCite Webinar, which defined what pharma marketers and meeting planners need to know when it comes to meetings-related HCP reporting.

Topic headings include:

- How Much Does Pharma Spend on Meetings?

- Get Ready to Mitigate Your Risk

- PhRMA’s Code and State Laws

- Meeting and Event Spend per Attendee Break Down by Industry (chart)

- Review of the Physician Payment Sunshine Act

- Case Study: Millenium

- Integration with CRM Systems

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-218x150.jpg)

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)