“According to a new study by TNS Media Intelligence,” reports Advertising Age, “DTC spending is down for the second consecutive year and likely will not reach the $5 billion mark by the end of 2008 that many media companies had counted on.” (See “DTC Spending Falls for Second Consecutive Year“).

“According to a new study by TNS Media Intelligence,” reports Advertising Age, “DTC spending is down for the second consecutive year and likely will not reach the $5 billion mark by the end of 2008 that many media companies had counted on.” (See “DTC Spending Falls for Second Consecutive Year“).

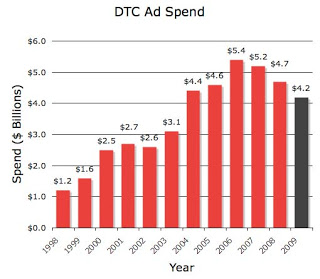

I’ve plotted the numbers in the chart in the left (click on the chart to enlarge). The 2008 bar represents TNS’s projection based on data from the first 8 months of 2008. It’s a 9.6% drop from 2007, which was 3.7% less than 2006.

Nothing to “get alarmed about,” says Bob Erhlich of DTC Perspectives (see his blog). He was basing his remark on his own estimate that the decrease will only be 6-8%. If I were a DTC ad agency, I’d be alarmed even with an 8% decrease in business!

What’s alarming, however, is that this measured media spend may be a bellwether for pharma spending across the board, including online spending — which I heard is also down, down, down — and professional (ie, physician) ad/marketing spending.

And it’s likely to get worse before it gets better, which is reflected in the last, very dark, bar of the chart. This is my prediction for DTC spending in 2009.

Why do I think DTC spending will decrease by 11% year-over-year in 2009? Simple:

- We’re in a world-wide recession that economists predict will last longer than any recession in recent history and as Bob Ehrlich admits, “I doubt 2009 will be a year of risk taking.”

- I don’t see any new DTC-worthy blockbuster drugs on the horizon that will boost DTC ad spending in 2009.

- Even if there were new drugs approved soon, it is likely that the industry — under pressure from Congress — will impose a 1-year moratorium on DTC advertising for any new drugs brought to market in 2009 (see my post: “An Experiment: Ban All DTC Broadcast Advertising for One Year“).

- There will be increasing pressure on pharmaceutical marketers to prove to managed care organizations, insurers, and Medicare (which may be given the power to negotiate drug prices) that brand name drugs are effective.

Direct-to-Payer Convincing Will Replace Direct-to-Consumer Advertising

The last point is important. I believe the era in which drug companies can speak directly to consumers to influence them to ask for expensive drugs is over. The new focus will be on payers to convince them that they should pay for new drugs based upon evidence. I will write more about this in the upcoming November, 2009 issue of Pharma Marketing News (see preview here; subscribe now to get it free).

Perhaps DTC advertising will be replaced by DTP — Direct to Payer — convincing!

So, I predict DTC spending will decrease by 11% in 2009 compared to 2008. Why 11% and not 5% or 2%? Just my gut and compared with other numbers I am hearing about in other industries.

P.S. Keep in mind that the numbers from TNS are “measured media,” which does not include search engine marketing, but does include web-based display ads. I suspect that online ad spending, in general, is under-represented in the TNS numbers. While other industries — eg, package goods — are spending more online and less on broadcast advertising (see “Kellogg Bolsters Digital ROI as Online Push Continues“), I’ve seen indications that pharma is cutting back on online spending.

You’re welcome to give your opinion on the future of DTC advertising in the following survey:

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)