Pharma Industry News Update: 11 July 2017

Funding of Digital Health “Moonshots”

Investors Gone Crazy!

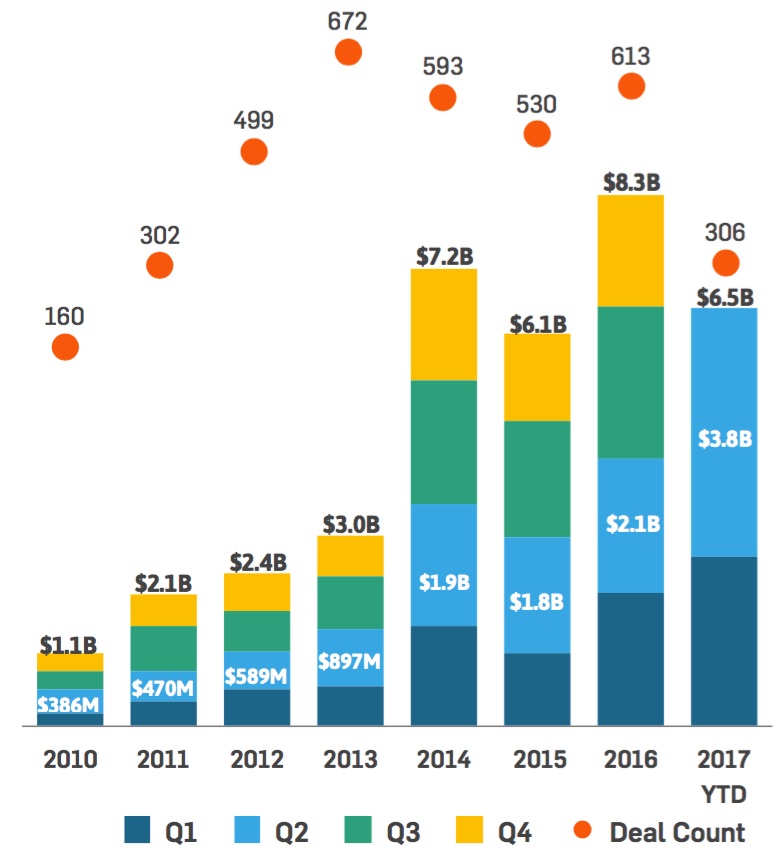

[From www.fiercehealthcare.com] Digital health companies saw a massive round of funding in the second quarter of 2017, putting the industry on track for a record-setting year.

Investors sunk $3.8 billion into the digital health industry during the second quarter, outpacing funding during every other quarter dating back to 2011, according to data compiled by StartUp Health. By comparison, digital health funding reached $2.1 billion during the second quarter last year.

The lucrative quarter pushed this year’s total funding to $6.5 billion, putting the industry on pace to exceed last year’s annual funding total of $8.3 billion.

Further Reading:

- The Pharma Digital Health Accelerator Club

- Venture Capitalists Credit Affordable Care Act for Spurring Flow of Money into #Mobile, Wearable Health Tech

- Pharma Investing Across Digital Health, Biotech, And Medical Devices

- Bayer HealthCare Adds 5 Startups to its #G4A Digital Accelerator Program

Many digital health solutions – especially mobile health apps – are failing the usability test (see here). And when pharma gets involved there are also regulatory and ethical hurdles to overcome. Take the “Pharma Mobile Health App Best Practices Survey” to provide your opinion on those “hurdles.”

Many digital health solutions – especially mobile health apps – are failing the usability test (see here). And when pharma gets involved there are also regulatory and ethical hurdles to overcome. Take the “Pharma Mobile Health App Best Practices Survey” to provide your opinion on those “hurdles.”

Pharma Payments to HCPs Tops $8 Billion

Allergan & Celgene Paid Out the Most!

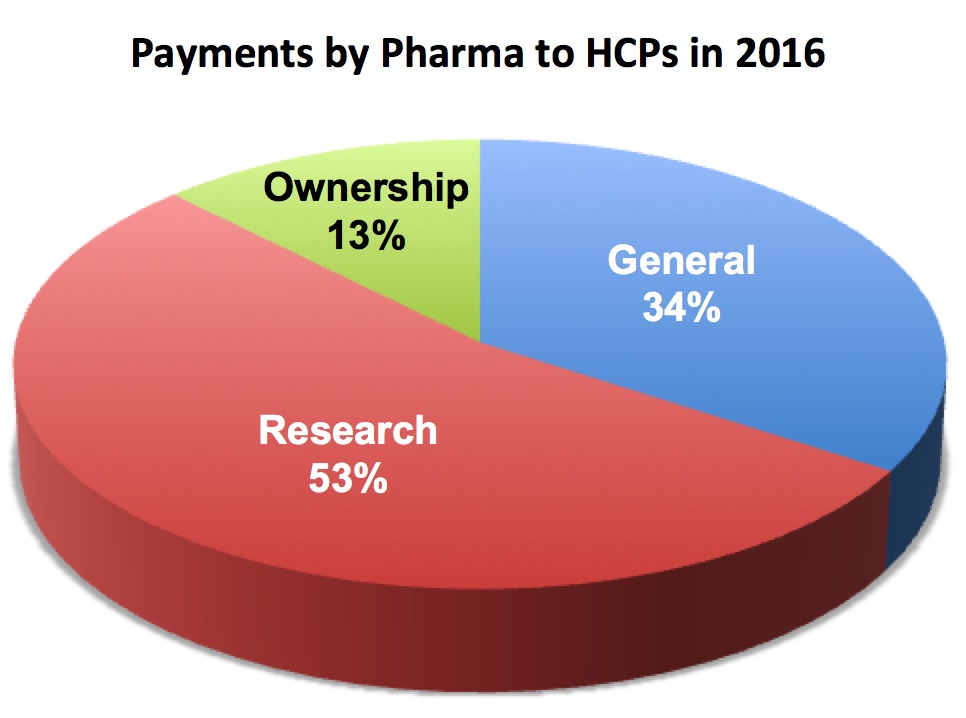

[From www.modernhealthcare.com] Payments from drug and device companies to physicians and teaching hospitals hit more than $8 billion in 2016 according to Open Payments data recently released by CMS.

All told, nearly 631,000 physicians and approximately 1,146 teaching hospitals received $8.18 billion in payments and ownership and investment interests in 2016, according to tallies compiled by the CMS. Last year’s total was $7.52 billion.

Of the largest pharmaceutical companies, Allergan paid out the most in 2016 with $66 million in total payments. Celgene was the second-highest spender with a total of $54 million in payments last year.

Comments from LinkedIn Friends

Oliver Hauss, Trainer & Consultant at Dr. Hauss Training & Consulting, said: “What are these payments for? It’s a bit more complicated than ‘The pharmaceutical industry has used physicians’ – a physician who is already influential is thanks to his reputation likely to be asked for advice by both industry and the FDA. So in and of itself, it’s not too surprising that they both get payments from drug companies (compensation for their advice) and are influencing FDA drug panels. More analysis needed, this is not sufficient to have evidentiary character.”

Oliver Hauss, Trainer & Consultant at Dr. Hauss Training & Consulting, said: “What are these payments for? It’s a bit more complicated than ‘The pharmaceutical industry has used physicians’ – a physician who is already influential is thanks to his reputation likely to be asked for advice by both industry and the FDA. So in and of itself, it’s not too surprising that they both get payments from drug companies (compensation for their advice) and are influencing FDA drug panels. More analysis needed, this is not sufficient to have evidentiary character.”

Further Reading:

![]()

FDA Study of DTC Ads on Smartphones: They’re Not So “Smart” When It Comes to Fair Balance

FDA Study of DTC Ads on Smartphones: They’re Not So “Smart” When It Comes to Fair Balance

[From www.statnews.com] A new study by Food and Drug Administration staffers found that risks are not as “equally prominent and accessible” on smartphones, suggesting that many drug makers are not complying with regulations about providing information with so-called “fair balance.” The study was published earlier this week in the Journal of Medical Internet Research.

The agency’s staff reviewed 51 promotions and divided these into three categories: a product claim that included the name of a drug along with risks and benefits; reminder ads that only include a drug name; and so-called help-seeking promotions that include a medical condition, but not the name of a drug.

What did they find?

Well, of 21 product claim communications, 95 percent required scrolling to see all of the risk info, but only 24 percent required scrolling to see all of the benefits. And of 19 communications that presented both risk and benefit info, 95 percent presented the risks first and 47 percent used a bigger font for benefits than for risks, the researchers found.

Further Reading:

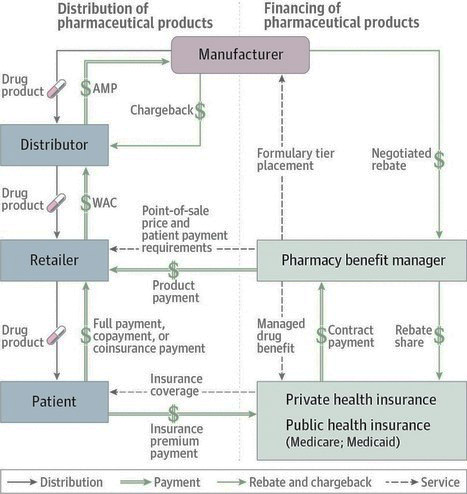

Financing and Distribution of Drugs in U.S.

Adapted from a Figure by the Congressional Budget Office

[From jamanetwork.com] Services represent contractual relationships between entities. Rebates are payments from manufacturers to pharmaceutical benefit managers. Chargebacks are payments from manufacturers to distributors. Retailers include pharmacies, hospitals, group purchasing organizations, and mail-order programs. AMP indicates average manufacturer price; WAC, wholesale acquisition cost.

![6 Digital Tools at the Center of Healthcare Digitalization [INFOGRAPHIC]](http://ec2-54-175-84-28.compute-1.amazonaws.com/pharma-mkting.com/wp-content/uploads/2021/04/6DigitalTools_600px-100x70.jpg)